The second largest economy in the world practically stopped.

The rapid spread of the coronavirus is a severe blow to the global economy, which was on the threshold of a modest revival. Of course, the extent of the damage depends on how soon and how effectively will be localized flash. Whatever the trajectory of the epidemic, a moment of serious reckoning for China’s economy.

It is hard to imagine that the second largest economy in the world almost stopped. Infection and deaths in connection with the spread of the coronavirus only increase. Many in China say that they are increasingly concerned about the government’s ability to control the epidemic and its economic consequences. Major manufacturing and financial centers remain at least partially blocked, the migrant workers are unable to return to work, and factories cannot get the raw materials or securely ship their goods.

Consumption also declined sharply, as people generally remain isolated in the premises. Were especially affected the service sector, such as tourism and restaurant business. Companies in this sector, as well as small-scale producers and stimulate the growth of employment in China, but they have, as a rule, few financial resources and growth opportunities.

Beijing has a chance to increase public spending, reduce taxes and provide cheap loans to support the growth of small and medium businesses. China’s Central Bank has already taken steps to ease monetary policy. However, filling the economy with cheap loans will increase the risks for the banking system, recognized by the government, but there are no other options, these are desperate times.

In any case, none of these measures will not have a significant impact, while commercial activity does not increase. Moreover, traditional China’s banking system became more direct loans to large state enterprises, not small private companies facing problems.

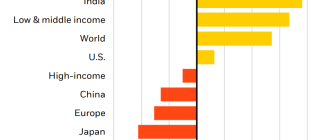

The huge size of China along with its role of engine of global economic growth and a dominant player in commodity markets means that a blow to China will have severe consequences worldwide. Oil prices fell in connection with the weakening of growth prospects of China and the reduction in international travel, especially in and out of China.

This episode will also add impetus to some changes in the global supply chains that have occurred previously. Along with the rising wages of Chinese workers and the prospects for further trade tensions in the United States and China, the epidemic is likely to force multinational companies to rethink their supply chains and to reduce production capacity in China or even transfer them to other countries.

The epidemic of the coronavirus may have only a limited direct impact on the US economy, but creating additional uncertainty and violating supply chain in Asia, it will add a long list of factors that can restrain the growth of the US and world economy in 2020. A temporary boost in business fluctuations and investment that could be expected from a trade deal between the US and China last month, will be offset by this new cloud of uncertainty as to world trade. The global recession has not yet come, but, at least, the added uncertainty will deter investment and productivity, which has looked anemic in all major economies.

Important:we recommend to watch the first symptoms of the coronavirus in humans and preventive measures to reduce the chance of infection. A graph that is on the main page of our project is a detailed online map of coronavirus with data updates every 15 minutes.

Other long-term exposure is likely to be the trust of Chinese citizens to their government. The state and its people, apparently, made an implicit deal: the good economic performance, a higher standard of living and the visibility of social stability in exchange for restrictions on freedom of speech, democratic rights and the free flow of information.