What are the best strategies for managing and reducing financial debt?

Financial debt can be a significant burden for many individuals and families. It can cause stress, limit financial freedom, and hinder long-term financial goals. However, with the right strategies and mindset, it is possible to manage and reduce financial debt effectively. In this article, we will explore some of the best strategies for managing and reducing financial debt, providing valuable insights and tips for readers to implement in their personal finance journey.

1. Create a Budget

One of the first steps in managing and reducing financial debt is to create a budget. A budget helps you understand your income, expenses, and where your money is going. Start by listing all your sources of income and then track your expenses for a month. Categorize your expenses into fixed (rent, utilities) and variable (entertainment, dining out) categories. This will give you a clear picture of your spending habits and areas where you can cut back.

2. Prioritize Debt Repayment

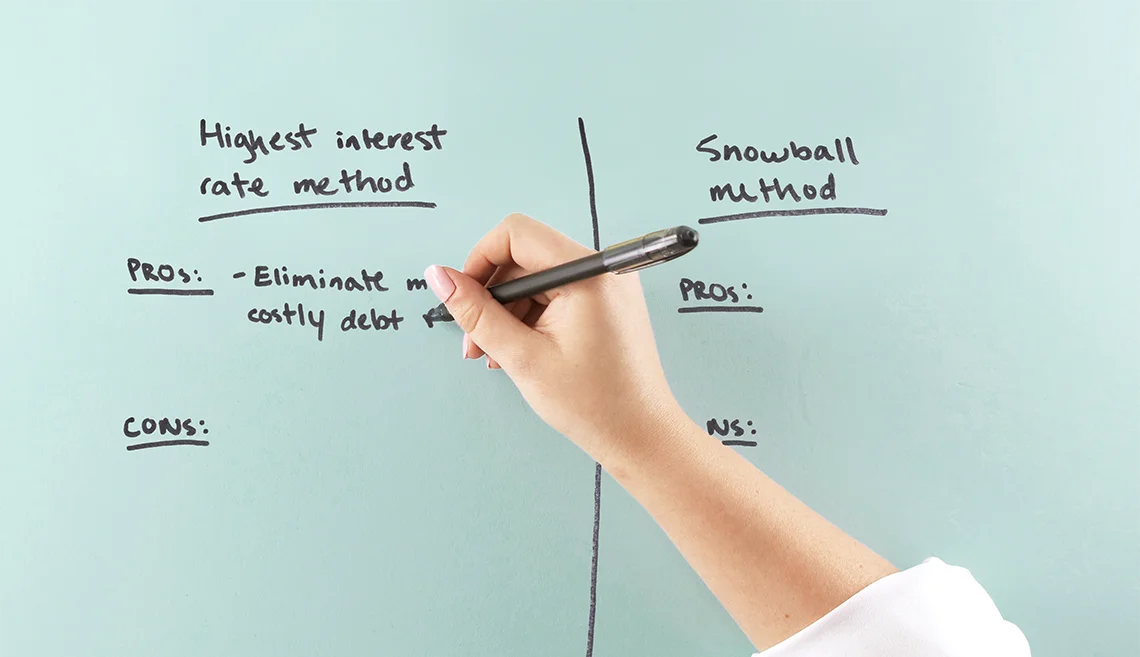

Once you have a budget in place, it’s important to prioritize debt repayment. Identify your debts and their interest rates. Start by paying off high-interest debts first, such as credit card debt. Make minimum payments on all other debts while allocating extra funds towards the debt with the highest interest rate. This strategy, known as the debt avalanche method, helps save money on interest payments in the long run.

3. Consider Debt Consolidation

If you have multiple debts with high-interest rates, it may be beneficial to consider debt consolidation. Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify your debt repayment process and potentially save you money on interest payments. However, it’s important to carefully evaluate the terms and fees associated with debt consolidation before making a decision.

4. Negotiate with Creditors

If you’re struggling to make payments on your debts, it’s worth reaching out to your creditors to negotiate new terms. Many creditors are willing to work with borrowers to create more manageable repayment plans. This could involve reducing interest rates, waiving late fees, or extending the repayment period. It’s important to communicate your financial situation honestly and be proactive in finding a solution.

5. Cut Expenses

Reducing expenses is a crucial part of managing and reducing financial debt. Look for areas where you can cut back on discretionary spending, such as eating out, entertainment, or subscription services. Consider making small lifestyle changes, such as cooking at home more often, using public transportation, or canceling unused memberships. Redirect the money saved towards debt repayment to accelerate your progress.

6. Increase Income

In addition to cutting expenses, increasing your income can help expedite debt repayment. Look for opportunities to earn extra money, such as taking on a part-time job, freelancing, or starting a side business. Use the additional income solely for debt repayment to make a significant impact on reducing your financial debt.

7. Build an Emergency Fund

While it may seem counterintuitive to save money while in debt, having an emergency fund is crucial for long-term financial stability. Without an emergency fund, unexpected expenses can lead to more debt. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This will provide a safety net and prevent you from relying on credit cards or loans in times of financial emergencies.

8. Seek Professional Help

If you’re overwhelmed with your financial debt or struggling to make progress, seeking professional help can be beneficial. Consider working with a certified credit counselor or a financial advisor specializing in debt management. They can provide personalized guidance, help you create a realistic repayment plan, and negotiate with creditors on your behalf.

Conclusion

Managing and reducing financial debt requires discipline, commitment, and a well-thought-out strategy. By creating a budget, prioritizing debt repayment, considering debt consolidation, negotiating with creditors, cutting expenses, increasing income, building an emergency fund, and seeking professional help when needed, individuals can take control of their financial debt and work towards a debt-free future. Remember, it’s important to stay motivated and celebrate small victories along the way. With perseverance and the right strategies, financial freedom is within reach.

Recent Posts

How do I create an engaging and informative online quiz or assessment?

Creating an engaging and informative online quiz or assessment can be a powerful tool for… Read More

What are the most effective methods for managing and reducing work-related stress in the hospitality industry?

Work-related stress is a common issue in the hospitality industry, where employees often face long… Read More

How can I improve my assertiveness and communication skills in a leadership position?

In a leadership position, assertiveness and effective communication skills are crucial for success. Being able… Read More

What are the key elements of a successful employee recognition and rewards program?

Employee recognition and rewards programs play a crucial role in motivating and engaging employees, as… Read More

How do I effectively manage and respond to customer feedback and reviews?

Customer feedback and online reviews play a crucial role in shaping a company's reputation and… Read More

What are the best strategies for effective time management as a stay-at-home parent?

Effective time management is crucial for stay-at-home parents who juggle multiple responsibilities on a daily… Read More